When I first left the comfort of my college dormitory, looking for a place to rent in the busy city, I wondered to myself: “How much should I spend on rent?”. I have friends and family telling me not to spend too much on rent but there are many factors to consider when looking for a comfortable place to call home.

Like it or not, monthly housing cost is often the main driving factor and it ties closely to how much you make every month.

Hence, it is important to consider a few guidelines to determine how much of your monthly income should you contribute to rent expenses.

How much of my income should go to rent? – The 30% rule

Believe it or not, there is a universally accepted recommendation of how many percentages of your income goes to rent. When it comes to how much money you can afford on rent, 30% of the monthly income is our universal rule of thumb.

To help you visualize that, assuming you earn a gross income of $4,000 every month before deductions for tax and retirement schemes. The recommended contribution towards rent is $4,000 x 30%, giving you a monthly budget of $1,200 for rent expenses.

In general, you should not spend more than 30% of your income on rent and accommodation expenses. The 30% rule has roots in the 1969 amendment to public housing requirements, was well accepted then but it does not cater to the modern living expenses and individual financial profile.

A little of quick history, the 30% rule was first mentioned in the 1969 amendment to the public housing requirements, also known as Brooke’s amendment. At the time of introduction, it was used to cap public housing rent at 25% of the tenant’s annual income. This approach by the U.S government focuses on what the consumers were spending rather than looking at what consumers should be spending on housing.

Moving forward into the 2000s, we see that median rent is increasing faster than annual wages. In 2010 alone, the median rent is 17.5% of the annual wages as compared to the 14.8% when the 30% rule was first introduced.

Is the 30% Rule Perfect?

The 30% rule is not a “one size fits all” guideline because it does not consider the individual’s unique financial situation. Individuals earning below the median annual wage will find difficulty applying the 30% rule while high-income earners typically see their rent expense at 15%.

Here are some quick reasons why the 30% rule is not perfect!

The 30% rule does not work if you are earning below the median wages

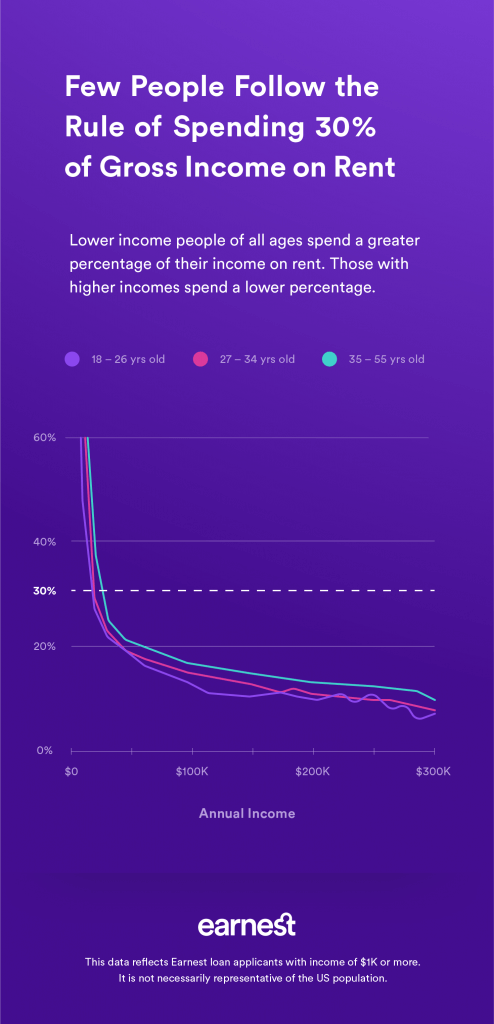

From a study conducted by Earnest covering 15,000 student loan applicants, it is common for individuals to spend above 30% of their gross income on housing at salary levels below $30,000.

When the household has income between $30,000 – $45,000, 45% of the households have rent expenses above 30%.

The reality is, at income above $30,000, it is easier for you to commit to a 30% rule for rent expenses. As your capacity to earn improves, the monthly rent expenses gradually decrease below the benchmark 30%. In some cases, it is possible to go down to around 10% of the gross income for the wealthiest renters.

The 30% rule does not consider your financial commitments

Student loans, hire purchase, retirement savings.

The issue with the 30% rule is that it does not consider your unique financial circumstances.

Let’s assume you make $2,500 per month with no household debt. According to the 30% rule, you will have a $750 budget on rent, leaving you with $1,750 for savings and expenses, not considering taxes yet.

So what happens if I happen to have a high-interest student loan? Can I still survive on a 30% rule?

Can I survive on a $2,500 monthly wages on a 30% rule for rent?

(+) Income : $2,500

(-) Rent @ 30% : $750

(-) Food @ 20% : $500

(-) Transportation : $500

(-) Student loan : $200

(-) Entertainment : $300

(-) Insurance : $100

(=) Savings : $150Ideally, it is best to spend less on rent and increase savings to contribute into investments.

If you are swimming in high-interest student loan debt, you will be better off financially to prioritize paying those off. If you want to spend less on rent, consider bringing some roommates to split the financial burden.

In contrast, if you are earning $20,000 per month, the 30% rule states you ought to be spending $6,000 a month on rent. In most cases, it is more responsible to consider putting that money into a mortgage loan to buy a house or condominium.

The 30% rule as the guideline

Ultimately, the 30% rule should be treated as a guideline when determining how much to spend on rent. It is important to look at your overall financial picture and allocate a suitable budget towards rent while taking into consideration other priorities such as savings, investments and paying off debts.

Hidden Rental Expenses You Should Consider

Knowing how much you can afford to spend every month on rent is essential. However, most renters forget to consider the hidden costs of renting.

The most often missed renting costs are the additional expenses, be it a cost or benefit, incurred due to living in a specific place. These costs can add up to significant levels in the long run.

In some cases, it might be more worthwhile staying nearby your workplace despite the higher rent. The time saved on traffic and commute can be better used on building your side hustle or business.

I will cover a few costs in my opinion worth considering,

1. Commute

Did you know the average Malaysian spends 60 minutes one way to get to work?

If you consider the number of workdays in a year, that is 31,320 minutes (522 hours) spent on commuting. These are precious times that can be enjoyed at home with friends and family or be used to work on a side hustle.

To put it into better context, 522 hours spent on commuting equals 65 working days. That is a total of 2 months every year you can use to grow your business.

2. Transportation

Proximity to public transportation is a common factor most of my clients will consider when choosing a place to rent. If taking public transport is your main mode of getting around, then you want to be living nearby the transportation hub.

Even if you do own a car, having the option for getting around using public transport can be added value to your rental place.

3. Parking

Let’s admit it, parking is not free and will perhaps never be free.

Ideally, you want to check if the condominium includes a parking space. If they do not, how much does it cost to have a dedicated parking space? Considering the cost of a parking space, are you still able to allocate a comfortable budget for rent?

4. Amenities

Do you need a gym membership if your condominium has a gym and swimming pool?

Being able to cancel your current gym membership is extra money in your pocket that can be contributed towards an investment plan.

Final Words

How much should you spend on rent is eventually determined by how much you make every month, taking into consideration the living expenses, financial commitments and monthly subscriptions.

The 30% rule is a good guideline to have but before calling it a day, it is best to write out an overview budgeting plan of your personal financing picture. This will give you a clear idea of how to adjust the 30%.